What has changed, why it matters, and how to apply it correctly

federal tax update

(obbba)

" One Big Beautiful Bill Act "

cpe Credits:

(3 Taxes)

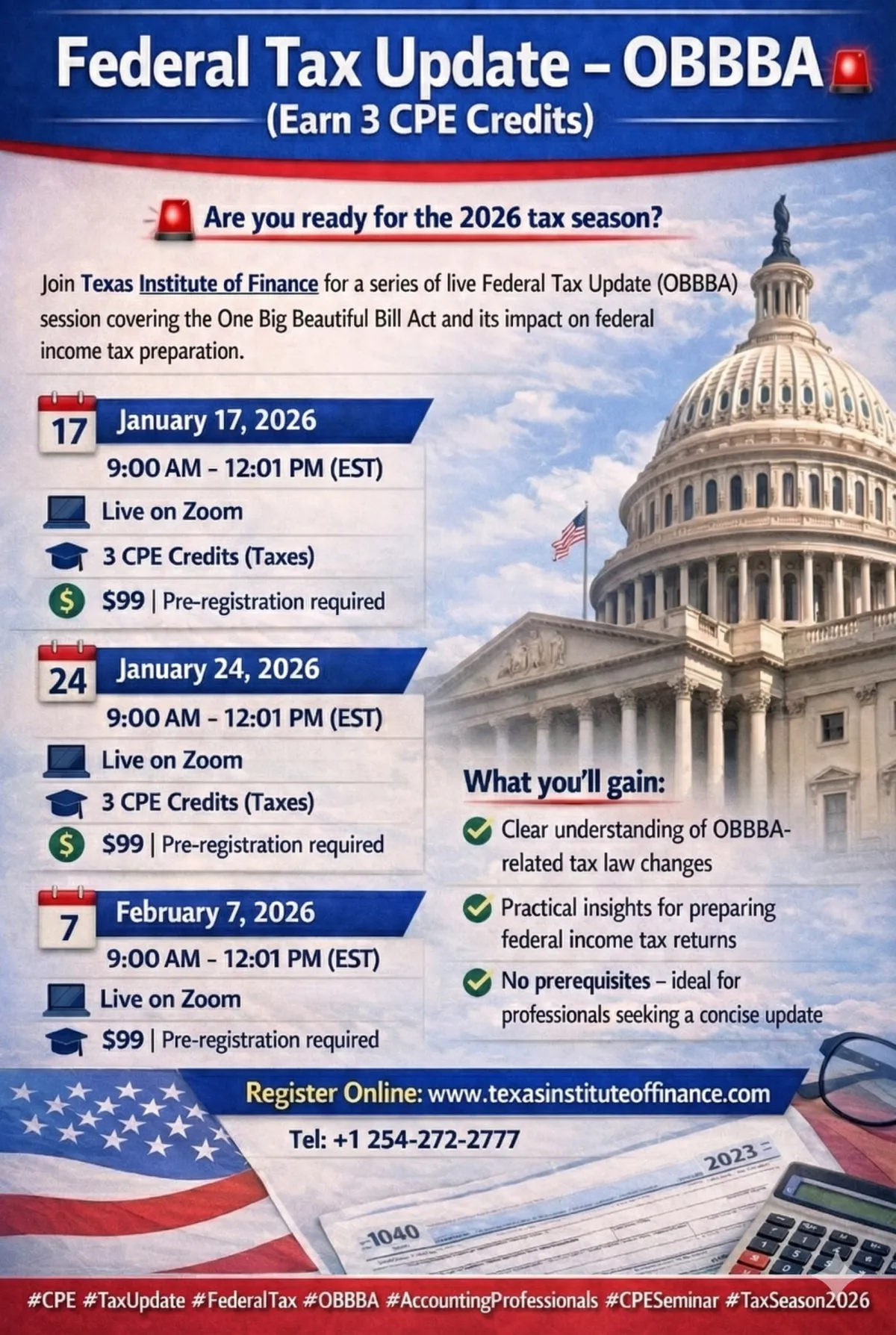

This course explains the impact of the One Big Beautiful Bill Act (OBBBA) on 2026 tax filings. We will highlight the changes and make you ready for upcoming tax season.

The Federal Tax Update (OBBBA) course is designed to equip accounting and tax professionals with timely, practical, and actionable knowledge of the One Big Beautiful Bill Act (OBBBA) and its implications for 2026 federal income tax filings.

As legislative changes continue to reshape the U.S. tax environment, professionals must understand what has changed, why it matters, and how to apply it correctly. This course focuses on translating complex legislative updates into clear tax preparation guidance, ensuring accuracy, compliance, and confidence during the upcoming tax season.

CPE Information

Recommended CPE Credit: 3 CPEs

Field of Study: Taxes

Texas Institute of Finance is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of Continuing Professional Education. Final acceptance of CPE credits is determined by individual state boards of accountancy.raph Font

Key Learning Outcomes

Why This Course?

Participants often face:

- Uncertainty around new tax law provisions

- Risk of incorrect application of legislative changes

- Limited time to review lengthy legislative texts

- Pressure to remain CPE-compliant while staying current

This course addresses these challenges by offering a focused, instructor-led breakdown of OBBBA changes relevant to federal income tax preparation.

One Big Beautiful Bill Act (OBBBA)

Understand the structure and intent of the One Big Beautiful Bill Act (OBBBA

income tax changes affecting 2025–2026 filings

Identify key income tax changes affecting 2025–2026 filings.

Apply updated rules when preparing federal income tax returns

Tax Optimization

Reduce compliance risk by recognizing areas of change requiring attention.

Enter the 2026 tax season with clarity and preparedness

Detailed Program Content

Overview of the One Big Beautiful Bill Act (OBBBA)

- Legislative background and scope.

- Effective dates relevant to upcoming filings

Income Tax Preparation Changes for 2025–2026

- Key updates affecting federal income tax returns

- Areas of change practitioners must address during preparation

Practical Application for Tax Professionals

- How changes impact day-to-day tax preparation work

- Common considerations and compliance focus areas

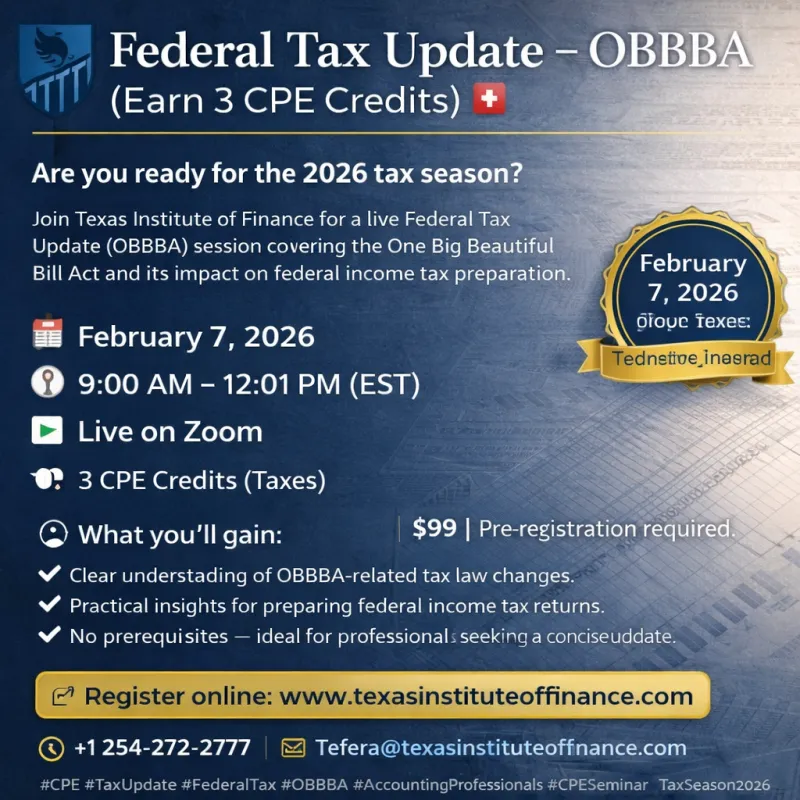

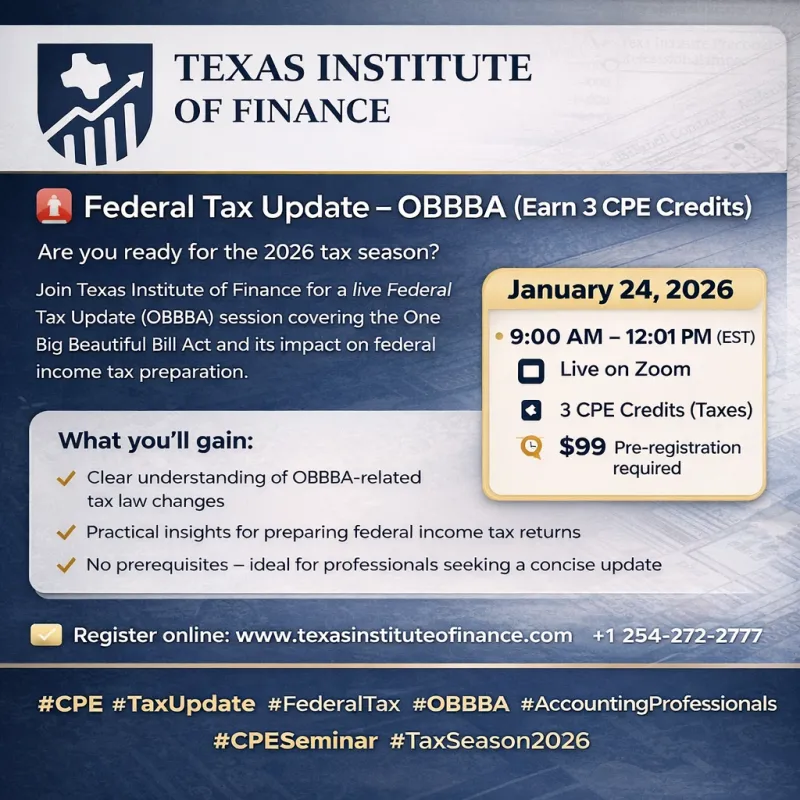

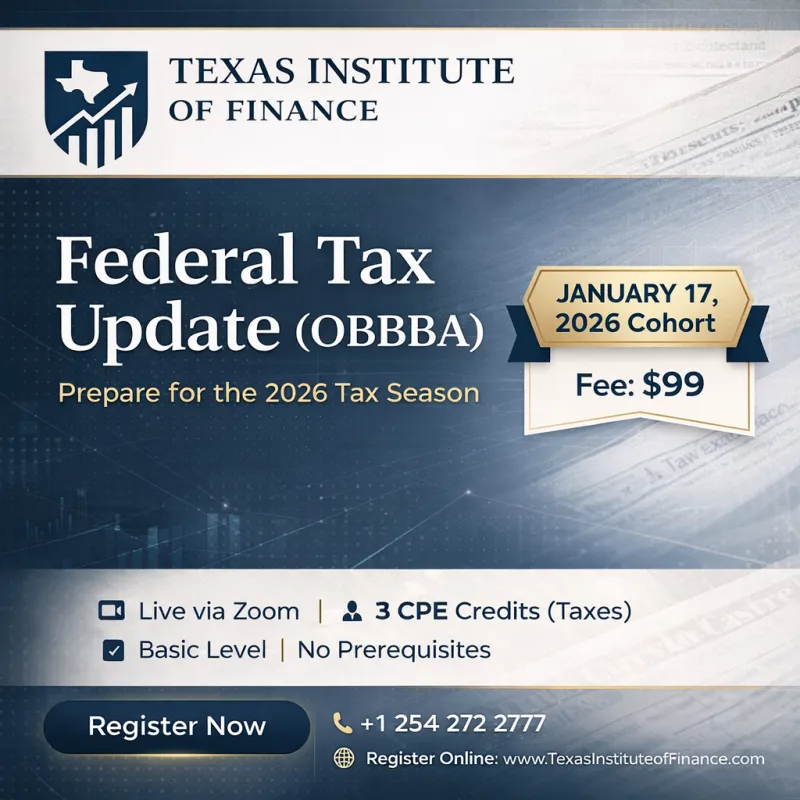

Register your slot now!

TRAINER

Dr. Tefera Tibebu Beyene, PhD, MBA, CPA, CBA, CGMA, MCSI, CWM®, Ch.E.

Dr. Beyene has over 25 years of extensive experience in management, accounting, finance, and taxation, gained through roles in corporate, government, and international settings. His expertise in tax accounting and the structuring of complex financial instruments was honed during his time with the State of Illinois Department of Revenue and the IRS Financial Products Specialists division.

In addition to his practical experience, Dr. Beyene is an accomplished academic, serving as an adjunct professor at numerous universities, including UCLA, APU, STU & PSU, where he teaches accounting, tax, finance, and economics courses. He is also involved with the American Academy of Financial Management (AAFM), where he teaches and serves as a chief nominator for North America and Africa.

Dr. Beyene holds a PhD in Applied Management & Decision Sciences with a concentration in Accounting, as well as an MBA with dual concentrations in Accounting & Finance. He is a licensed Certified Public Accountant in Illinois, Maryland, Virginia, and the District of Columbia. He is a fellow and member of the AAFM and holds the Certified Chartered Economist and Chartered Wealth Management certifications. Furthermore, he is a chartered member of the Chartered Institute for Securities & Investment (UK). His professional affiliations also include the AICPA, AAA, and NACM, where he holds the Credit Business Associate certification.

Dr. Beyene is also an author, having written “Personal Finance Demystified” and co-authored “Financial Markets, Institutions & Regulations, Money, Capital, & Derivative Markets.

Thanks to their financial planning services, I now feel secure about my future and my family’s financial well-being!

Retired Engineer

Got Question?

We've got answers

In your freelancing journey, you likely have many questions and concerns. Our goal is to help you navigate through them, which is why we've compiled answers to the most common questions. Whether you need insights on budgeting, taxes, or financial planning, our comprehensive FAQ section is here for you. If you don’t find your question listed, feel free to ask us—we’re here to assist you!

What are the best budgeting practices for freelancers?

Freelancers should track all income and expenses meticulously. Consider using budgeting apps or spreadsheets to categorize expenses and set financial goals. Aim to save a portion of your income each month to cover lean periods.

How do I handle taxes as a freelancer?

As a freelancer, you are responsible for reporting your income and paying taxes. It's essential to keep detailed records of your earnings and expenses. You may want to consult a tax professional to understand your obligations and maximize deductions.

What should I include in my financial plan?

A comprehensive financial plan for freelancers should include budgeting, savings goals, retirement planning, and an emergency fund. Additionally, consider setting aside money for taxes and investing in professional development.

How can I manage irregular income?

Managing irregular income involves creating a buffer. Set aside a portion of your earnings during high-earning months to cover expenses during leaner times. Building an emergency fund can also provide stability and peace of mind.

What are the advantages of having a separate business account?

Having a separate business account helps streamline your finances by keeping personal and business expenses distinct. This makes it easier to track income, manage cash flow, and prepare for taxes, reducing the risk of financial confusion.

We look forward to welcoming you to this important federal tax update session.

...The One Big Beautiful Bill Act (OBBBA) introduces important updates impacting 2026 federal tax filings.

Contact Us

Texas Institute of Finance

Email: [email protected]

Tel: +1 254-272-2777

1846 E. Rosemead Pkwy #1139

Carrollton, TX, 75007

Website: www.TexasInstituteofFinance.com